Safeguarding Your E-commerce Business: Understanding Fraud Types, Risks, and Prevention Strategies

Lotfi Zazoun

•

Business Operations

•

August 26, 2024

•

5 min min read

In this blog we are going to explore the risks of e-commerce fraud, outline common fraud techniques, and offer strategies to protect businesses.

E-commerce has transformed shopping, making it more accessible and personalized. However, this convenience comes with a risk: online platforms are a prime target for cybercriminals. The ability to store sensitive financial and personal information makes both businesses and customers vulnerable to various forms of eCommerce fraud.

E-commerce fraud includes activities like credit card fraud, identity theft, and phishing. Whether it's a fraudulent transaction or a full account takeover, the impact can be severe. In 2022 alone, the Federal Trade Commission reported $186.1 million in losses from online fraud,numbers that reflect only reported cases.

This guide delves into the types of e-commerce fraud, the risks they pose, and best practices for detection and prevention. We’ll also explore how leveraging software like Tapper can help you mitigate these risks and protect your business from substantial financial losses.

Types of E-commerce Fraud

Hackers employ various methods to compromise accounts and access sensitive personal information. Although the specific goals of these attacks can differ, once an account is breached, it often becomes part of a larger network of compromised data, making it more vulnerable to further exploitation.

Here’s a look at some common techniques fraudsters use in e-commerce fraud. These methods can be employed individually or as part of a broader, coordinated attack campaign.

Card Testing Fraud

Card testing fraud involves fraudsters making multiple small transactions on an e-commerce website using stolen or fraudulent credit card information. The goal is to identify active cards and assess their credit limits. These small transactions often go unnoticed by eCommerce platforms until larger, more damaging purchases are made.

The immediate concern is the loss of revenue from invalid payments, but the impact extends beyond that. Each fraudulent transaction comes with additional costs, including packaging, shipping, and product loss. Over time, these losses can add up significantly. Moreover, businesses that fall victim to card testing fraud may face further expenses related to investigating and resolving the fraudulent activity.

Chargeback Fraud

Chargeback fraud, often referred to as "friendly fraud," occurs when a customer disputes a legitimate charge on their credit card, seeking a refund for a product they actually received. Common claims include the product not being as described or not being delivered. In some cases, organized scam groups use stolen credit cards to make purchases and later dispute them.

For businesses, chargeback fraud can be especially damaging. Similar to card testing fraud, all associated costs,shipping, packaging, and product,become a loss when a chargeback is successful. Additionally, credit card companies often impose fees for each chargeback, leading to further financial strain on the business over time.

Interception Fraud

Interception fraud is a prevalent threat in e-commerce, where cybercriminals intercept sensitive information exchanged between an eCommerce site and its users. This can include crucial data like credit card details and personal information.

The objectives of interception fraud can differ. In some cases, attackers aim to acquire products by purchasing items using a victim's account, then manipulating customer service to redirect the delivery to the fraudster's address. More concerning is when hackers use interception fraud to take over an entire e-commerce site, capturing customer or admin login credentials through phishing schemes and malware designed to steal credentials.

With the right strategy, interception fraud can be effectively prevented, protecting both your customers and your business from significant harm.

Account Takeover Fraud

Account takeover (ATO) fraud happens when a fraudster gains unauthorized access to a customer’s e-commerce account. This can occur through phishing, social engineering, or exploiting security flaws on the website. Once inside, the attacker can access personal information, financial details, and purchase history. With this access, they can make unauthorized purchases and extract sensitive data.

On a larger scale, bots are often used to carry out these attacks. For example, "credential stuffing" involves using combinations of email addresses and passwords from previous data breaches or phishing attempts to test login credentials on e-commerce sites. This is just one of many bot-driven techniques that scammers use to execute account takeovers.

Social Engineering Fraud

Social engineering fraud involves con artists using psychological manipulation, often through social media, to trick victims into revealing sensitive information or taking certain actions. Victims may be more willing to share personal details, such as passwords, when they believe they can trust the scammer.

For e-commerce sites, social engineering fraud poses a significant threat. For example, a scammer could create a fake email account, contact the business, and impersonate a customer locked out of their account. In response, the business might send a password reset link, unknowingly granting the scammer unauthorized access to the victim’s account.

Impact of E-commerce Fraud on Businesses

eCommerce fraud can have devastating effects on businesses, extending beyond financial losses. Here are some key consequences of an e-commerce fraud attack:

- Financial losses: businesses hit by e-commerce fraud often bear the cost of chargebacks when customers dispute charges. They may also incur expenses from replacing stolen goods and covering additional shipping costs, leading to substantial financial setbacks.

- Reputation damage: when customer information is compromised, trust in the business erodes. Customer loyalty is crucial for success, and losing it can have long-term detrimental effects on the company’s reputation.

- Legal liabilities: failing to deliver ordered products or protecting customer data can expose businesses to legal risks. This can result in financial penalties, legal fees, and compensation claims.

- Increased customer service workload: fraudulent activities consume significant time and resources. Businesses must address customer complaints, track packages, and handle chargebacks, straining the customer service team and potentially neglecting other customers.

- Disruption of delivery and supply chain: certain types of fraud, such as interception fraud, can redirect large volumes of packages, causing delays, extra costs, and revenue losses due to backorders.

- Regulatory compliance issues: fraudulent transactions can lead to non-compliance with regulations like the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR), resulting in fines and legal consequences.

Best Practices for Protecting Your E-commerce Business from Fraud

Safeguarding your online business against fraud is essential for long-term success. Implementing effective strategies can help you avoid financial losses and mitigate other risks. Here are key practices to enhance your company's security and ensure customer satisfaction:

- Keep software updated: regularly update your website and payment gateway software to protect against information leaks, privacy vulnerabilities, and compromised systems. Keeping your software current ensures you have the latest security features.

- Monitor suspicious activity: early detection of fraud is crucial. Pay attention to unusual behaviors, such as orders from high-risk regions or mismatched billing and shipping addresses. Reviewing these can help prevent significant financial losses.

- Set order and purchase Limits: reduce the risk of fraud and chargebacks by imposing daily limits on the number and value of purchases from a single account. This simple measure can protect your business from fraudulent orders.

- Educate your customers: make customers aware of fraud prevention measures. Include tips during the checkout process, create a dedicated FAQ page, and ensure your customer service is equipped to address concerns about fraud and online security.

- Ensure PCI compliance: adhering to PCI (Payment Card Industry Data Security Standards) compliance is crucial. These standards help protect sensitive customer information by requiring regular security assessments to identify and fix vulnerabilities in your systems.

- Invest in a comprehensive security solution: consider using a go-to-market security platform like Tapper to combat e-commerce fraud effectively. These platforms offer visibility into fraudulent activity, challenge cybersecurity threats, and automatically block malicious actions, providing robust protection for your business.

Maintaining Customer Trust and Ensuring E-commerce Security with Tapper

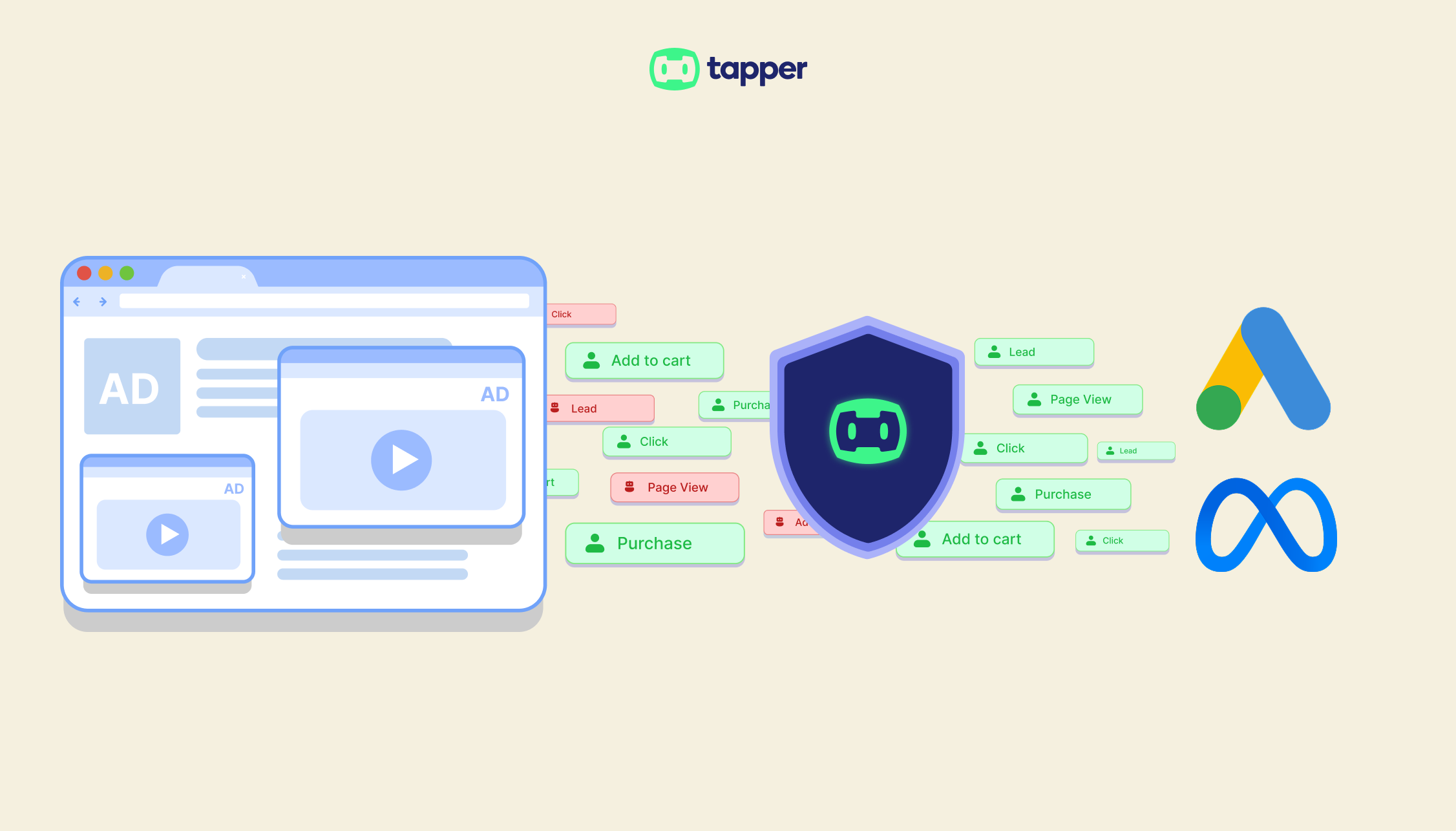

With Tapper, businesses can confidently protect against fraud using the industry’s first full-funnel security platform. Tapper offers over 2,000 cybersecurity challenges for suspicious traffic and automatically blocks malicious activity. This proactive approach allows online businesses to concentrate on their products without getting bogged down by reactive fraud protection measures.

Stop Paying for Fake Traffic

Run a 30-day Tapper trial to set your baseline CPA, block invalid traffic in real time, and receive a final report comparing your CPA before and after protection.

Get your free trial